Australian exports surge despite China hostility, ASX follows.

Despite Beijing's increasingly hostile trade war, Australia sold a lot more goods to China (particularly iron ore) in December.

Key points:

- Australian CPI (inflation) is expected to rise 0.7pc in the December quarter

- Apple, Facebook and Tesla will report quarterly results on Thursday (AEDT)

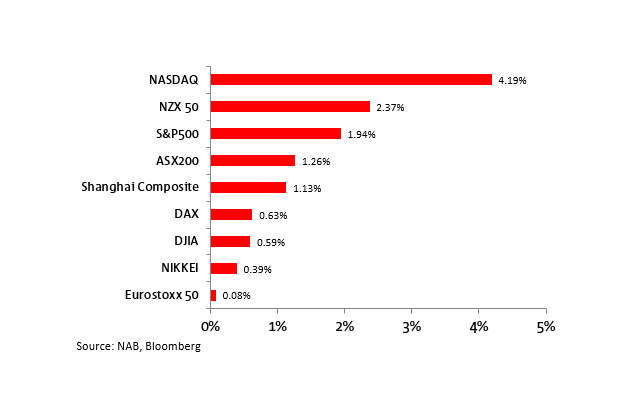

- The Australian share market is trading around its highest level since February 26, 2020

Australia managed to divert its coal and barley shipments to other countries like Japan and India, according to the Bureau of Statistics' (ABS) latest preliminary trade data.

China imposed crippling tariffs on Australian barley in May, a decision which the the Federal Government is appealing to the World Trade Organization (WTO).

It also also imposed an unofficial ban on Australia's coal shipments, slapped huge tariffs on the wine industry, among many other restrictions on goods like timber, lobsters and beef.

However, the surprisingly strong ABS figures did very little for the local share market, which crept to an 11-month high, or the Australian dollar, which is still trading near a 2.5-year high.

"The strong surplus is heavily influenced by trade with China," the ABS said in a statement on Monday.

Exports to China went up $2.3 billion (+21pc) in December, compared to the previous month — while imports fell $641 million (-7pc).

All up, this sent Australia's monthly trade surplus with China (for goods) surging to $5.2 billion.

Around 40 per cent of Australia's exports go to China, which underscores the economic importance of the nation's second-largest trading partner.

Conversely, about 29 per cent of Australia's imports (particularly electronics and mobile phones) come from China.

Fourth largest trade surplus ever

According to the ABS December data, the "big picture" is that the value of Australia's:

- exports went up to $34.9 billion — a big jump compared to November (+16.3pc), and marginally higher than it was a year ago (+2.5pc).

- imports fell to $25.97 billion — a significant fall compared to the previous month (-8.8pc), and slightly lower than the previous 12 months (-0.1pc).

Overall, Australia recorded its fourth-largest monthly trade surplus (for goods) on record, at $8.96 billion — after the value of imports were subtracted from exports.

The ABS said the strong December exports figure was driven by Australia selling a lot more of these goods overseas:

| Commodity | Change in sales |

|---|---|

| Metalliferous ore |

|

| Cereals |

|

|

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.