Obama Orders ‘Immediate Stand-down’ After Deadly North Korean Attack

By: Faal, and as reported to her Western Subscribers

Russian foreign military intelligence directorate (

GRU) reports circulating in the Kremlin today are stating that President Obama has ordered all United Nations Forces on the Korean Peninsula into

“immediate stand-down” over fears South Korea will retaliate against the North for the deadly missile attack on one of its ships that has left an estimated 46 of its Naval Forces dead and warned liable to start a nuclear weapons exchange should tensions escalate further.

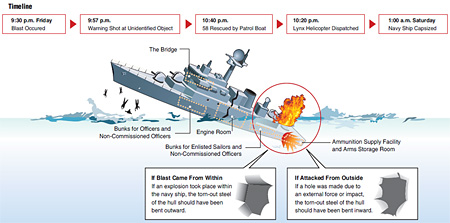

Sparking this latest conflict was an

“unprovoked” attack on South Korea’s Cheonan warship

[photo 2nd left], a Pohang-class corvette (

PCC-772), patrolling in neutral waters of the Yellow Sea when it was struck by a Chinese made

Silkworm missile fired from a North Korean shore battery. So powerful was the resulting explosion the Cheonan was

torn in half and 46 of its 104 member crew were annihilated.

[Note: Western reports show that

North Korea has been preparing for this attack

since last summer when it began training its Silkworm missile crews for a naval engagement along the Northern Limit Line with the South Korean Navy]

Upon the Cheonan’s sinking, its sister warship Daecheon (PCC-777) also patrolling these waters obliterated the North Korean shore battery that had fired the Silkworm missile with sustained artillery fire, after which no further hostilities were reported.

South Korea in following Obama’s orders not to escalate tensions in this already volatile region is

reporting to its people that the Cheonan’s sinking remains

‘mysterious’ and that the artillery fired by the Daecheon was not directed at North Korea, but was

‘mistakenly’ directed at a

flock of birds.

Important to note about this conflict are its origins from the aftermath of World War II when upon the Empire of Japan’s surrender (who ruled over the Korean peoples since 1910) the

Korean Peninsula was torn in two between its southern half backed by the West and its northern part by Communist Chinese and Russian forces.

Open conflict between the West and East on the

Korean Peninsula began on

June 25, 1950 when communist backed northern forces invaded the south and nearly succeeded in capturing the entire country. The North’s plan, however, was thwarted when United Nations forces (mostly Americans) led by US

General Douglas MacArthur carried out a successful sea invasion of South Korea’s third largest city

Incheon on

September 15, 1950.

So successful was General MacArthur’s war strategy that by late October, 1950, his forces had nearly totally annihilated the North Korean troops opposing him and were nearing the

Korean Peninsula’s border with Communist China. Unbeknownst to MacArthur, however, was that Communist China and Soviet Russia were not going to allow the Americans to succeed in crushing the North Koreans, and as we can read from the original communications exchanged between Chinese leader Mao Zedong and Soviet leader Joseph Stalin:

1 October 1950, Kim Il-sung sent a telegram to China asking for military intervention. On the same day, Mao Zedong received Stalin's telegram, suggesting China send troops into Korea.

5 October, under pressure from Mao Zedong and Peng Dehuai, the Chinese Communist Central Committee finalized the decision of military intervention in Korea.

11 October, Stalin and Zhou Enlai sent a joint signed telegram to Mao, stating:

11 October, Stalin and Zhou Enlai sent a joint signed telegram to Mao, stating:

1.Chinese troops are ill prepared and without tanks and artillery; requested air cover would take two months to arrive.

2.Within one month, fully equipped troops need to be in position; otherwise, US troops would step over the 38 parallel line and take over North Korea.

3.Fully equipped troops could only be sent into Korea in six months time; by then, North Korea would be occupied by the Americans, and any troops would be meaningless

12 October, 15:30 Beijing time, Mao sent a telegram to Stalin through the Russian ambassador: "I agree with your (Stalin and Zhou) decision."

12 October, 22:12 Beijing time, Mao sent another telegram: "I agree with 10 October telegram; my troops stay put; I have issued order to cease the advance into Korea plan."

12 October, Stalin sent a telegram to Kim Il-sung, telling him: "Russian and Chinese troops are not coming."

13 October, the Soviet ambassador in Beijing sent a telegram to Stalin, saying Mao Zedong had informed him that the Chinese Communist Central Committee had approved the decision of sending troops to Korea.

So as the Americans were preparing to celebrate their victory over North Korea the Chinese were preparing to unleash nearly 500,000 of their troops into this conflict, and which on November 1, 1950 they in fact did leading to a crushing defeat of UN Forces and causing the West’s retreat to the 38

th Parallel of the Peninsula where the war then broke down into a virtual stalemate after America’s President, Harry Truman, refused MacArthur’s pleas to use nuclear weapons.

[

Note: So enraged was MacArthur against President Truman that

rumors swirled that the World War II hero general was going to disobey his President’s orders and nuke Chinese forces anyway, and which when heard by Truman caused him to

fire one of the arguably most famous generals in the history of the United States.]

By the summer of 1953 both the West and East knew that without the use of nuclear weapons the war could not be won by either side so on July 27

th an

Armistice Agreement between the Commander-in-Chief, United Nations Command, the Supreme Commander of the Korean People's Army and the Commander of the Chinese People's volunteers was signed ceasing open hostilities, but not ending the war which continues to this very day.

Important to note is that then South Korean President Syngman Rhee refused to sign the Armistice Agreement brokered between the West and East and, also, to this very day

South Korea remains at war with its Communist Northern neighbor.

North Korea’s reason for launching this latest attack upon the South, these reports continue, was its growing anger over reports that the United States and South Korea were preparing to destabilize and then bring down their communist regime, and which this past week US Forces Korea Commander Gen. Walter Sharp in testifying before the American Congress warned of the need for

“urgent preparation” for the sudden regime collapse of North Korea’s government and military structure.

North Korea, predictably, did not take kindly to General Sharp’s testimony and through its official Korean Central News Agency warned that

“those who seek to bring down the system in the (North), whether they play a main role or a passive role, will fall victim to the unprecedented nuclear strikes of the invincible army”.

Interestingly about Obama in his administrations dealings with North Korea was his decision last month to leave them off of Americas list of countries supporting terror by his stating they

“do not meet the statutory criteria” for inclusion that automatically imposes sanctions. Leading one to wonder if the World’s most rogue regime who for decades

has supplied nuclear weapon and missile technology to some of the most dangerous Nations on Earth can’t be called a terrorist state then who can?

Former President Bush, on the other hand, had no qualms about calling North Korea what it in fact is, a terror state, when on January 29, 2002 in what is now called his

“Axis of Evil” speech before the US Congress he named them along with Iraq and Iran as the three most dangerous Nations on Earth.

Since Obama’s taking office though, what was to Bush the

“Axis of Evil” appears to be the new American Presidents

“Trio of Buddies” as he

continues to protect the Iranians while they construct an atomic bomb, Iraq has essentially become a protectorate of the Iranians, and now North Korea is allowed to attack US allies at will with no fear of retaliation…all occurring at the same time that he has turned his back on one of the United States most stalwart allies, Israel.

To what America has become there can no longer be any doubt, as aside from Obama’s refusing to listen to his own people suffering under the cruel communist regime being erected all around them, Americas once stalwart allies are now being cast aside too.

And to those Americans not believing what is happening to them under their

“change” President they should pay closer attention; such as when this past week

Cuba’s Communist leader Fidel Castro declared that the passage of Obama’s health care reform was

“a miracle” and a major victory for Obama's presidency.

At least Fidel knows a fellow communist dictator when he sees one, too bad the American people can’t see it too.