Last Monday the market immediately took out my stop of 1215 and closed below the upper Bollinger Band. The Stochastic has crossed down its own 80's signal line and the MACD has also crossed down negatively. All these 3 items gave us the initial reasons to sell. I would now use the middle band of 1209 as my new stop.

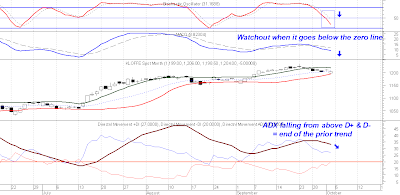

Please take note the ADX which has been holding above both the D+ and D- now has started to drop. This is usually a good confirmation that the prior (bull) trend has ended. I would add more new shorts when other signals start to fall in. These additional signals are when price closes below the lower band ; the D- crosses above the D+. Another major sell signal would be when the MACD crosses down its own zero signal line.

I am still unable to get any confirmation of a bear market at the weekly chart. Price still maintain above the upper Bollinger Band while the Stochastic also hold above its 80's signal line. The MACD is losing momentum as it has begun to drop its 'head', but it is still positive. So by the coming week I would watch out for:- 1) if it will close below1194 2) Stochastic crossing blow its 80's signal line and 3) MACD turning negative. If all these materialize, then you can sell more contracts into the market.

I have mentioned about the triple bearish divergences for the past few weeks. You should now really sit up and watch this market intensely.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.