skip to main |

skip to sidebar

How Debt-to-GDP Ratios Have Changed Since 2000

How Debt-to-GDP Ratios Have Changed Since 2000

Money

How Debt-to-GDP Ratios Have Changed Since 2000

Published 2 days ago

on April 18, 2024

By Marcus Lu

Graphics/Design:

Miranda Smith

Twitter

Facebook

LinkedIn

Reddit

Pinterest

Email

See this visualization first on the Voronoi app.

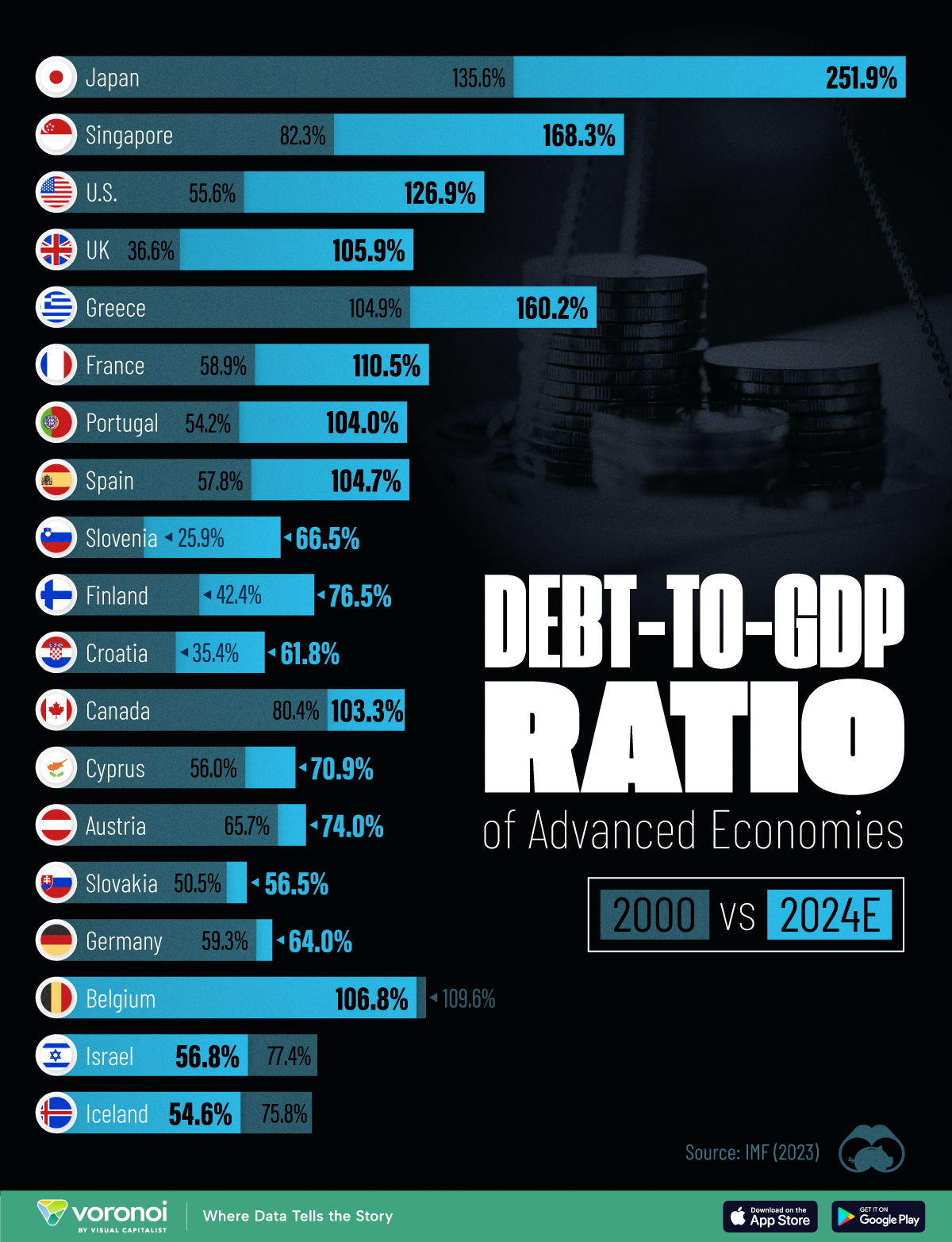

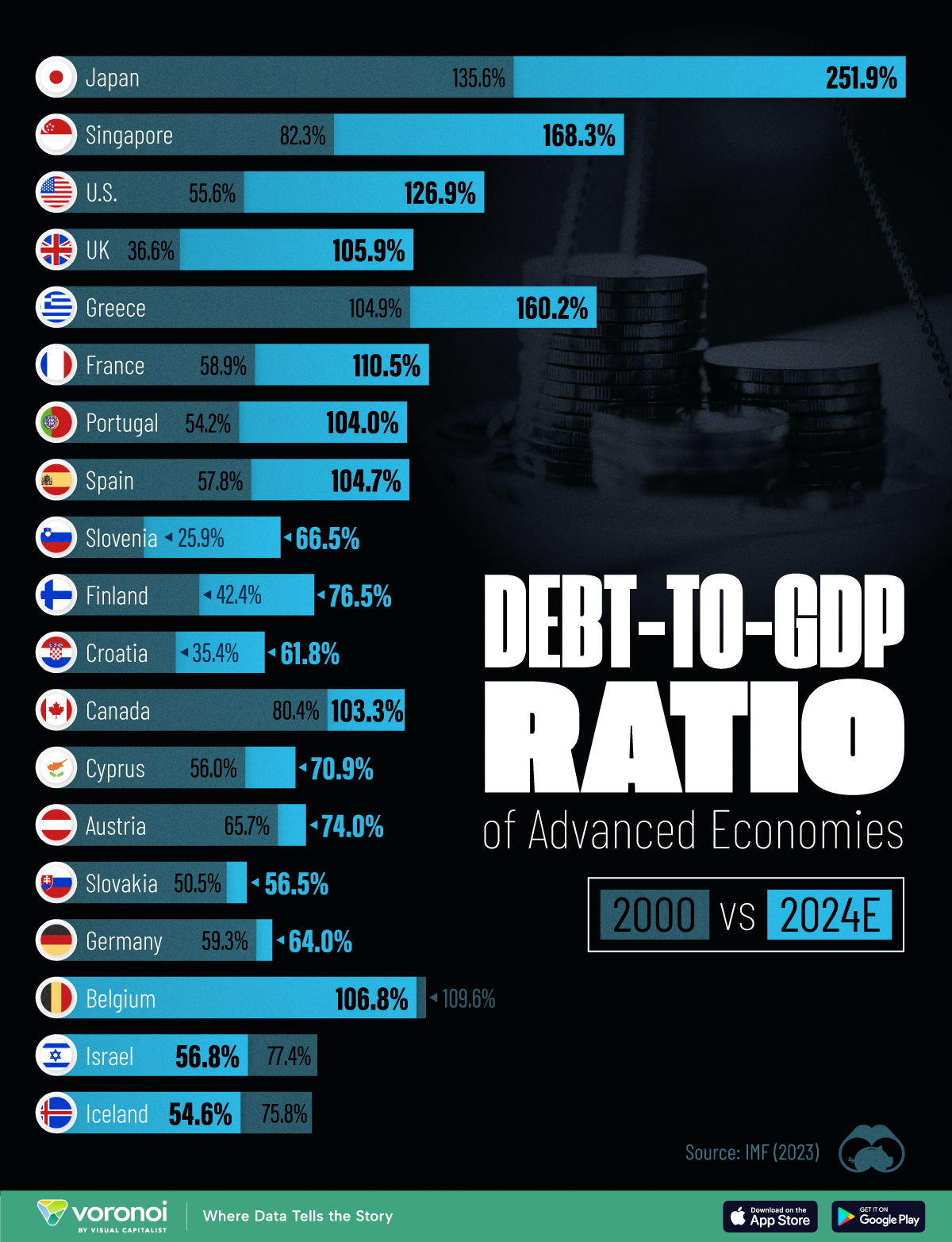

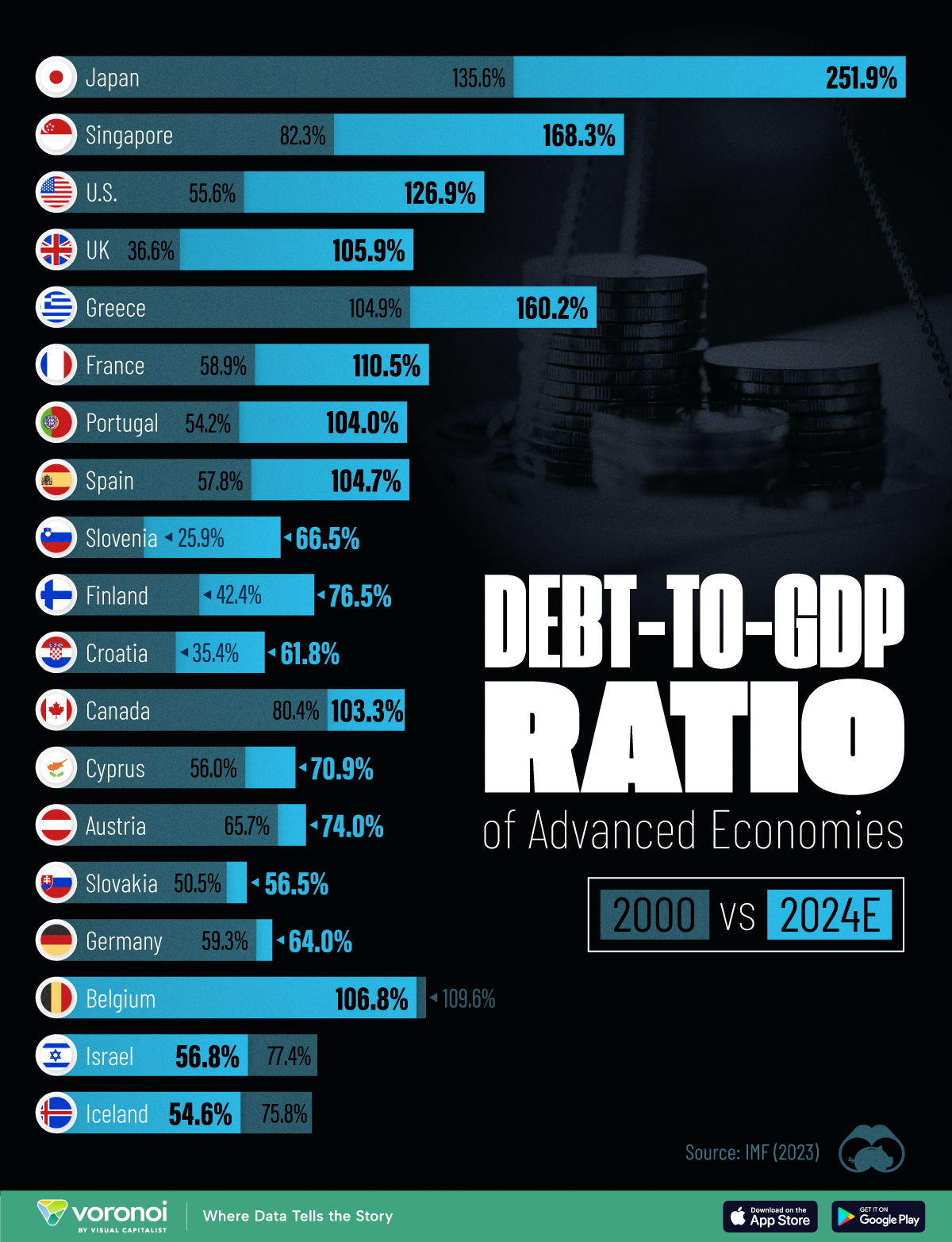

Chart comparing debt to GDP ratios from 2000 to 2024

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

Country 2000 (%) 2024 (%) Change (pp)

🇯🇵 Japan 135.6 251.9 +116.3

🇸🇬 Singapore 82.3 168.3 +86.0

🇺🇸 United States 55.6 126.9 +71.3

🇬🇧 United Kingdom 36.6 105.9 +69.3

🇬🇷 Greece 104.9 160.2 +55.3

🇫🇷 France 58.9 110.5 +51.6

🇵🇹 Portugal 54.2 104.0 +49.8

🇪🇸 Spain 57.8 104.7 +46.9

🇸🇮 Slovenia 25.9 66.5 +40.6

🇫🇮 Finland 42.4 76.5 +34.1

🇭🇷 Croatia 35.4 61.8 +26.4

🇨🇦 Canada 80.4 103.3 +22.9

🇨🇾 Cyprus 56.0 70.9 +14.9

🇦🇹 Austria 65.7 74.0 +8.3

🇸🇰 Slovak Republic 50.5 56.5 +6.0

🇩🇪 Germany 59.3 64.0 +4.7

🇧🇪 Belgium 109.6 106.8 -2.8

🇮🇱 Israel 77.4 56.8 -20.6

🇮🇸 Iceland 75.8 54.6 -21.2

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.