China’s belt and road lending under more scrutiny after IMF tightens debt limits

- China

is the largest bilateral creditor to developing nations, but it is

often criticised in the West for not offering enough transparency around

its lending

-

- But

tougher debt monitoring at the International Monetary Fund is

pressuring borrowers to disclose more information on Chinese loans,

observers say

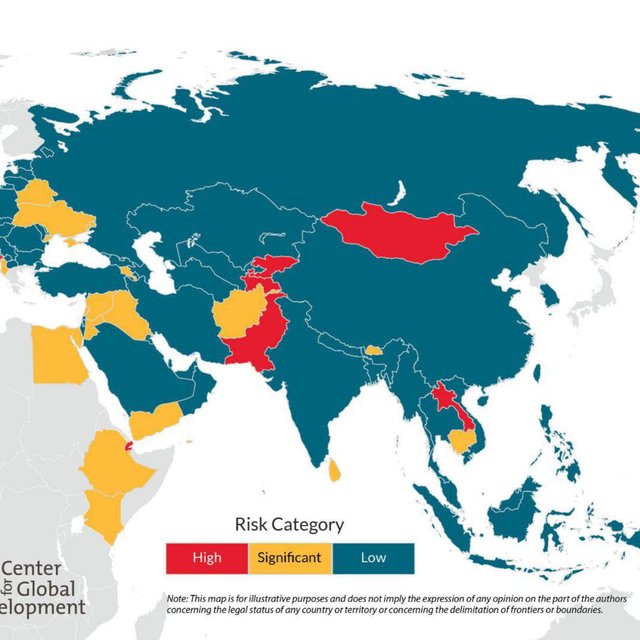

New transparency demands from global financial institutions aimed at preventing sovereign debt distress are starting to have an impact on China-backed infrastructure projects under the Belt and Road Initiative, experts say.

As global interest rates rise and concern about developing world debt risk swirls, “sustainability” and “transparency” have become buzzwords at organisations like the International Monetary Fund (IMF) and World Bank.

The international bodies, which have traditionally been controlled by the United States and other wealthy Group of 7 nations, are pushing for greater disclosure from borrowers, including on debt contracts with China, former senior staff and analysts say.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.