China’s youth unemployment hits record high

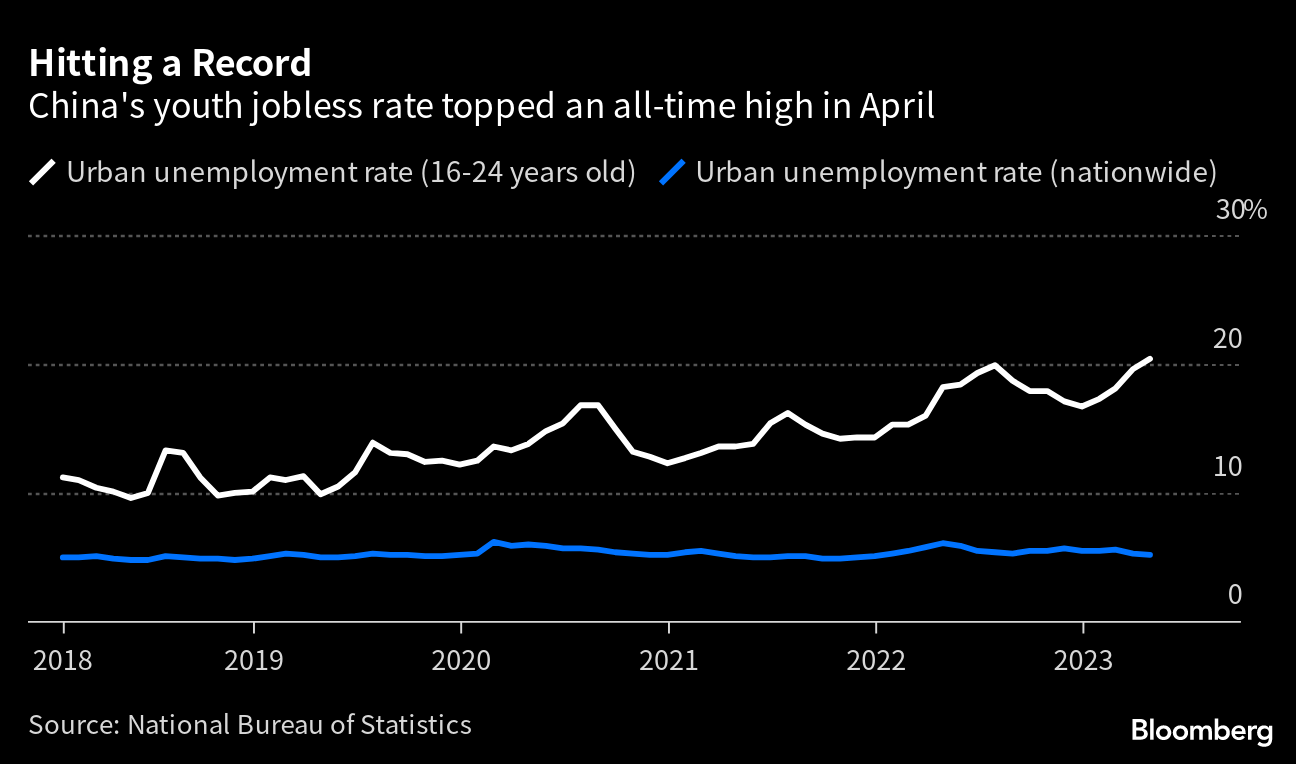

The urban surveyed jobless rate stood at 5.2 per cent in April, while the jobless rate for the 16-24 age group hit a record high 20.4 per cent last month.

Retail sales and industrial production also fell short of expectations last month amid China’s mixed economic recovery.Unemployment among China’s youth rose above 20 per cent for the first time in April, and the situation could continue to worsen, analysts said, presenting a growing economic and social risk for policymakers.

The jobless rate for the 16-24 age group hit a record high of 20.4 per cent in April, up from 19.6 per cent in March, the National Bureau of Statistics (NBS) confirmed on Tuesday.

The overall urban surveyed jobless rate stood at 5.2 per cent in April, down from 5.3 per cent in March, but with 11.6 million college graduates set to enter the workforce this year, youth unemployment could increase further in the coming months.

Adding to the mixed post-coronavirus economic recovery, China’s retail sales and industrial production also fell short of expectations last month. Four months into the reopening, China’s economic recovery can best be described as uneven, front-loaded, and still necessarily state-supported Louise Loo

Four months into the reopening, China’s economic recovery can best be described as uneven, front-loaded, and still necessarily state-supported Louise Loo“Economic activities were weaker than expected in April. The headline growth rate was high, but that’s due to the low base last year. The unemployment rate for the young labour force rose above 20 per cent, which is a worrying sign,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management.

Retail sales in China rose by 18.4 per cent in April, year on year, but the surge was largely caused by a low comparison base after the figure had dropped by 11.1 per cent in April last year. Retail sales in April also fell by 7.8 per cent from March, the official data showed.

Industrial production, a gauge of activity in the manufacturing, mining and utilities sectors, also rose by only 5.6 per cent in April, year on year, the NBS confirmed.

“Four months into the reopening, China’s economic recovery can best be described as uneven, front-loaded, and still necessarily state-supported,” said Louise Loo, lead economist at Oxford Economics

The record high youth employment, Loo added, could also present both an “economic and social risk” for Beijing.

Scarring from the coronavirus pandemic and a sluggish labour market mean that consumer confidence remains low despite domestic tourism revenues jumping to 101 per cent of pre-pandemic levels during the five-day “golden week” holiday, which started at the end of April.

April’s data suggests that China’s economic recovery has stalled, but is not “dead” yet, said Larry Hu, chief China economist at Macquarie Group.

“Overall, most data from April surprised to the downside, which has raised the concerns about the recovery,” he said.

“That said, economic data tend to be highly volatile in the early stage of recovery, as was the case in early 2016 and mid-2020.”

The recovery is likely to fizzle out during the second half of the year. Fiscal support is gradually being unwound Capital Economics

A weaker than expected recovery has prompted questions over the response from policymakers, as Beijing has prioritised stimulating domestic demand this year.

“Authorities’ policy reaction function is one to watch. The supposed natural buoyancy of consumer spending in the reopening process has not been quite as convincing enough for policymakers to take off their fiscal life jackets for the economy,” added Loo.

Analysts at Capital Economics said that the “reopening recovery still has legs left”, with consumer spending strengthening at the start of May, while income growth is likely to pick up to help underpin further gains in consumption.

“Our forecast for [gross domestic product] growth of 6.5 per cent this year still looks achievable, especially given the weak base for comparison from last year’s downturn,” they said.

“However, the recovery is likely to fizzle out during the second half of the year. Fiscal support is gradually being unwound.”

In other data released on Tuesday, fixed-asset investment – a gauge of expenditure on items including infrastructure, property, machinery and equipment – rose by 4.7 per cent in the first four months of 2023, year on year.

Investment in the property sector, meanwhile, fell by 6.2 per cent in the first four months of the year, down from a fall of 5.8 per cent in the first quarter.

The NBS said the national economy continued to recover in April, but acknowledged that the international environment is still “complex and severe”.

It added that domestic demand is still insufficient and the driving force of the recovery is still weak, meaning China needs to focus on restoring and expanding demand and promoting “quality and reasonable growth of the economy”.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.