The alleged sale of MAHB to pro-Zionist BlackRock from lenses of a young political activist

A CHINESE social media influencer has laid out in “seven threads” to counter Bersatu Youth chief Wan Ahmad Fayhsal Wan Ahmad Kamal that it is untrue the unity government has mortgaged global airports operator Malaysia Airports Holdings Bhd (MAHB) to the so-called pro-Zionist firm BlackRock.

Against the backdrop of the Machang MP’s relentless fault-finding mission against DAP secretary-general Anthony Loke Siew Fook, PKR’s student wing vice chairman Yap Xiang contended that the entire corporate exercise “is all part of the MAHB nationalisation plan”.

In the latest twist, Ahmad Fayhsal who is also the Perikatan Nasional (PN) deputy youth chief had on yesterday (May 20) referred Loke who is also the Transport Minister to the Dewan Rakyat’s privileges committee for allegedly lying/confusing the august house over the sale of a stake in MAHB to the “pro-Zionist entity”.

To recap, Loke told the Dewan Rakyat in March that Wan Fayhsal’s claims about a stake in MAHB being sold to Global Infrastructure Partners (GIP), a company wholly owned by BlackRock, were “merely an assumption”.

In a copy of his letter to the Dewan Rakyat secretary, Wan Fayhsal said Loke’s claim that it was “merely an assumption” gave the impression that he was both “spinning” and “making wild allegations” on the purported sale which has since been proven as true.

In his well-researched and reader-friendly presentation, Yap stated that sovereign wealth fund Khazanah Nasional Bhd currently holds a 33% stake in MAHB (the biggest shareholder) which is currently listed in the Main Market of Bursa Malaysia while retirement fund, the Employees Provident Fund (EPF), owns a 6% stake.

“Anybody else can purchase the rest of the shares (from the open market),” he shared in a post on the X platform.

Basically WAF tengah salahkan DAP atas Pelan Merakyatkan MAHB.

Tapi betul ke MAHB digadai kepada syarikat Zionis? Jawapannya tidak.

Sebelum kita bincang pasal Blackrock, kita kena fahamkan Pelan Merakyatkan MAHB ini.

— yapxiang #EndStatelessness (@yapxiang) May 20, 2024

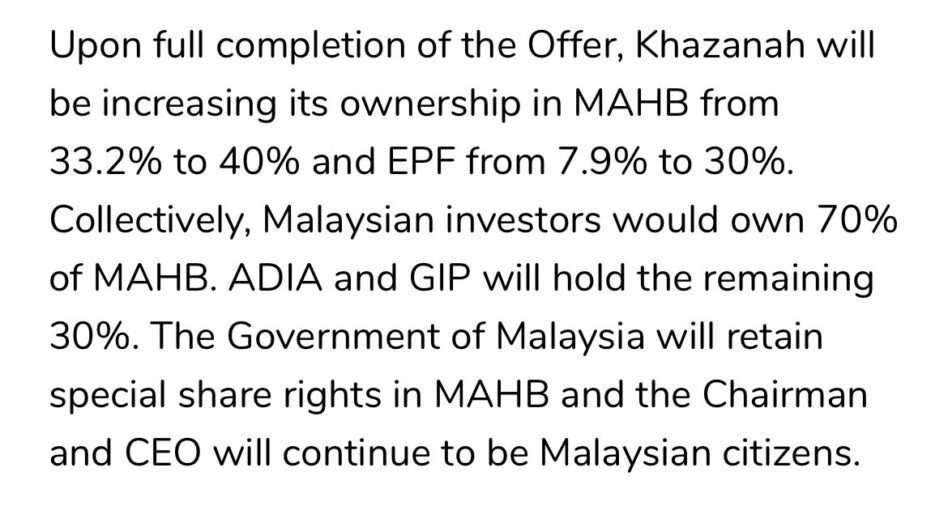

Upon MAHB’s privatisation, Yap noted that Khazanah’s share in MAHB will rise from 33% to 40% while that of EPF will jump from 6% to 30%.

“This means that Malaysians will own 70% of MAHB’s shares. The chairman and CEO of MAHB are still Malaysians,” he pointed out, referring to the MAHB media statement dated May 15 by the consortium led by Khazanah and EPF over its conditional offer for MAHB.

Nevertheless, Yap revealed the hardship in a privatisation exercise which is the need for “massive funding” to acquire the additional shares for both Khazanah and EPF.

“Henceforth, the role of BlackRock (the world’s largest asset manager with US$10 tril in assets under management as of end-December 2023.) and ADIA (Abu Dhabi Investment Authority). They help raise money and get minority shares in return.”

To the question why both Blackrock and ADIA can be so kind in wanting to help Malaysians”, Yap justified that they invest in MAHB because “they are confident in the future of MAHB and Malaysia”.

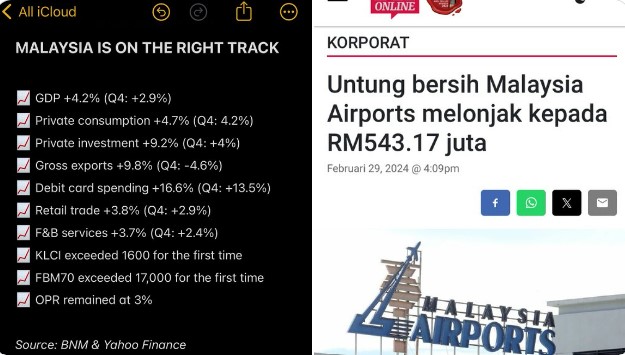

“After (Prime Minister Dastuk Seri) Anwar Ibrahim became PMX, MAHB stopped making losses while the Malaysian economy grew rapidly.”

So, who then is the biggest winner in the so-called “MAHB nationalisation plan”?

“Malaysians!!! Why? Because EPF ownership in MAHB has jumped from 6% to 30%,” asserted Yap. “Every profit generated through this 30% will be shared with Malaysians through EPF dividends.”

Therefore, Yap called on Ahmad Fayhsal “to stop terrorising” Malaysians just because BlackRock is involved in the exercise through its wholly owned Global Infrastructure Partners (GIP) which is itself a renowned global infrastructure investor.

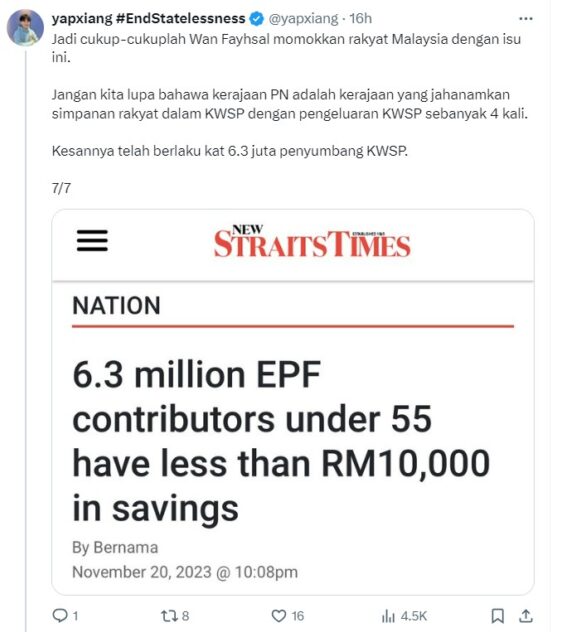

“Let’s not forget that the PN government was responsible in destroying the people’s savings in the EPF with four withdrawal approvals. The negative effect is now being felt by 6.3 million EPF contributors,” he argued.

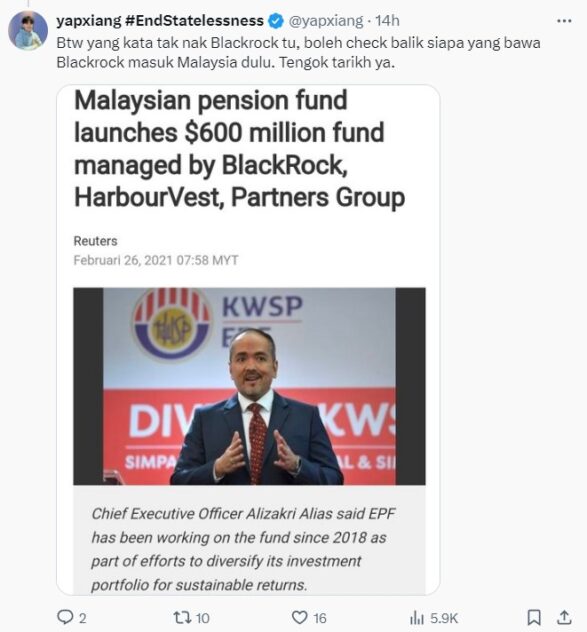

As a final swipe on PN, Yap also reminded the opposition coalition that it was the PN administration under eighth premier Tan Sri Muhyiddin Yassin (PN chairman/Bersatu president) who first brought BlackRock into Malaysia. – May 21, 2024

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.