CK Hutchison tilts more to Europe than China, results show, amid Panama row

Shares fall as Li Ka-shing empire feels geopolitical heat from Trump and Beijing.

The Hong Kong-listed shares of CK Hutchison Holdings, the business empire controlled by family of local tycoon Li Ka-shing, fell on Friday morning, the day after the group announced its annual earnings and cut its dividend.

The stock price declined by more than 3% to 43.35 Hong Kong dollars in early trading, outpacing the roughly 1% drop of the benchmark Hang Seng Index. CK Asset Holdings, another flagship conglomerate under Li Ka-shing's family, was down nearly 6% at HK$31.65, after the company announced a 20% fall in its annual net profit to HK$13.65 billion ($1.75 billion).

CK Hutchison shares have been under pressure as the company finds itself in a tight geopolitical spot. The group, now run by Li's eldest son, Victor Li Tzai-kuoi, is caught in a controversy over the sale of two Panama Canal ports and other maritime assets to a consortium led by U.S. investment fund BlackRock.

U.S. President Donald Trump had demanded that the strategic Central American waterway must not be run by China -- effectively equating the Hong Kong company's port operations with Chinese government control. But since CK Hutchison struck the "purely commercial" deal earlier this month, Beijing has made no secret of its displeasure, with state-endorsed newspaper commentaries blasting the group.

On Thursday morning, just ahead of the earnings announcement, Ta Kung Pao and Wen Wei Po -- the two daily Chinese-language newspapers controlled by the Liaison Office of the Central People's Government in Hong Kong -- carried fresh stories criticizing the Panama deal, stressing the importance of patriotism and the national interest.

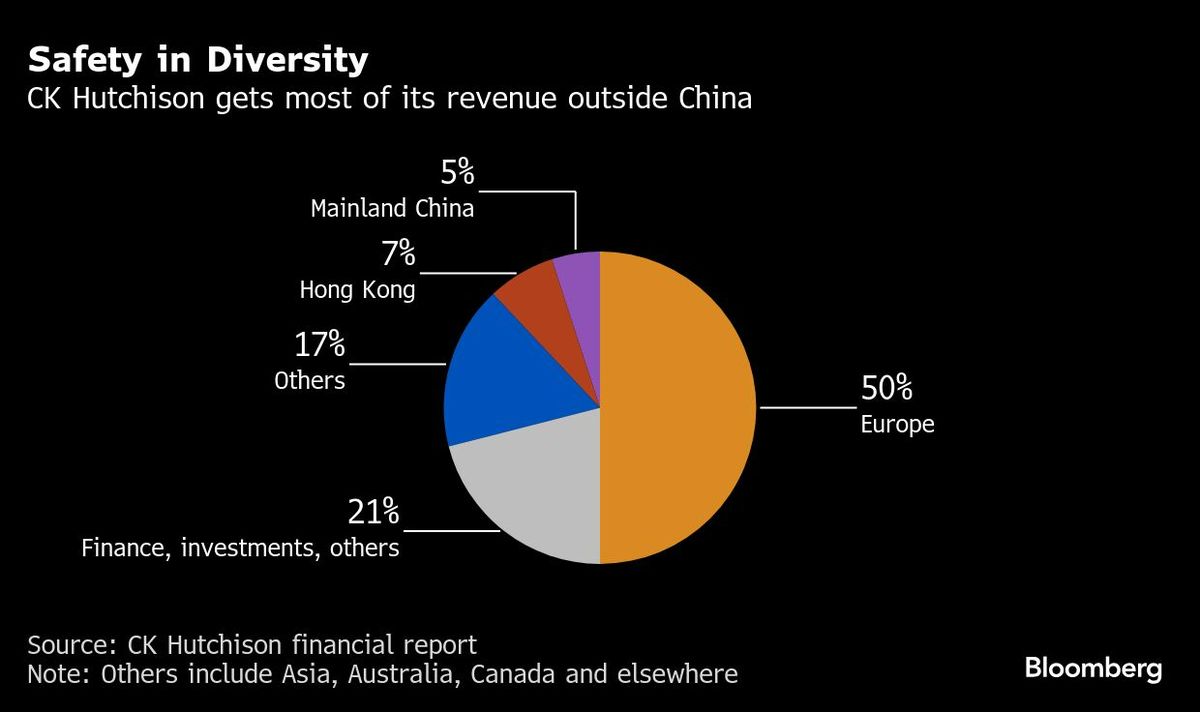

Yet CK Hutchison, which spans everything from retail to telecom and infrastructure, has diversified far beyond its roots -- underscored by its latest financial results, which painted a picture of business interests that are far more European than Chinese.

Total revenue in 2024 grew by 3% to HK$476.68 billion. Europe accounted for HK$244.37 billion, up by 5%. The region made up 52% of the entire top line, an increase from 50% a year earlier.

On the other hand, combined revenue from Hong Kong and mainland China was HK$58.24 billion, down by 6% and even smaller than that of the "Asia, Australia and others" geographic segment, which contributed HK$73.19 billion. The rest was from Canada, along with a category of "finance and investments and others."

The group's shift to Europe is evident in other metrics, too.

Last year, 52% of HK$54.43 billion in earnings before interest and taxes, or EBIT, and 51% of total group assets of HK$1.11 trillion were attributed to its European business.

Almost 80% of the total capital expenditure of HK$22.35 billion went to Europe, while less than 10% was for Hong Kong and mainland China combined.

Group net profit was down by 27% for the year to HK$17.03 billion, mainly hit by HK$3.74 billion in impairment and provision charges from its telecom business in Vietnam.

The final dividend per share was cut to HK$1.514 from HK$1.775 the year before, amid speculation about a large-scale special dividend if the port sale deal goes through as planned.

The company did not hold a news conference, while it hosted a meeting for analysts by invitation only. The company did not immediately respond to Nikkei Asia's query on why analysts and media were treated differently.

In Victor Li's chairman's statement, he mentioned that "there may be headwinds with supply chain disruptions anticipated in the early part of the year due to shipping lines transitioning into their new alliances, as well as ongoing geopolitical risk impacting global trade."

However, he did not touch on the Panama Canal row, conceding only that the "operating environment for the Group's businesses is expected to be both volatile and unpredictable." The younger Li said the group "will constrain capital spending and new investment and focus on stringent cash flow management" under this environment.

The company agreed to transfer the 90% interest it holds in Panama Ports Company to the BlackRock-led consortium, along with its 80% effective and controlling interest in 43 ports comprising 199 berths in 23 countries, with an aggregate value of $22.8 billion.

While the company insisted this was all about business, it seemed like a convenient -- and lucrative -- way to dodge Trump's wrath.

Trump had vowed to "take back" the Panama Canal, implying the U.S. might even use force if necessary. His view that the canal was under Chinese control was likely rooted in a decision made during his first administration, when the U.S. revoked Hong Kong's special status, meaning it would be "treated the same" as mainland China.

This was done on the grounds that China's national security clampdown on the city had breached the "one country, two systems" governance formula that was supposed to last until 2047 under the internationally binding Sino-British Joint Declaration.

Yet this is not the first time Li Ka-shing has come under criticism from Beijing as his Hong Kong empire has turned its focus overseas. The diversification strategy toward Europe -- which started when Li Ka-shing was still at the helm of the group, before he announced his retirement in 2018 -- was widely viewed as an effort to lessen the group's domestic exposure.

Nevertheless, CK Hutchison is now feeling the heat from not one but two superpowers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.