China’s regional banks facing US$300 billion shortfall, local government debt ‘pain could be too much to bear’

China’s regional banks facing US$300 billion shortfall, local government debt ‘pain could be too much to bear’

Regional banks could suffer a capital shortfall of 2.2 trillion yuan (US$301 billion) from China’s local government debt crisis, according to S&P Global Ratings

Amid concerns over default risks from local government financing vehicles (LGFVs), regional banks had about 12 trillion yuan of exposure as of the end of 2022 China’s regional banks could suffer a capital shortfall of 2.2 trillion yuan (US$301 billion) from a deepening local government debt crisis, according to S&P Global Ratings, highlighting the fallout from the turmoil in the property sector on the country’s financial system.

China’s regional banks could suffer a capital shortfall of 2.2 trillion yuan (US$301 billion) from a deepening local government debt crisis, according to S&P Global Ratings, highlighting the fallout from the turmoil in the property sector on the country’s financial system.

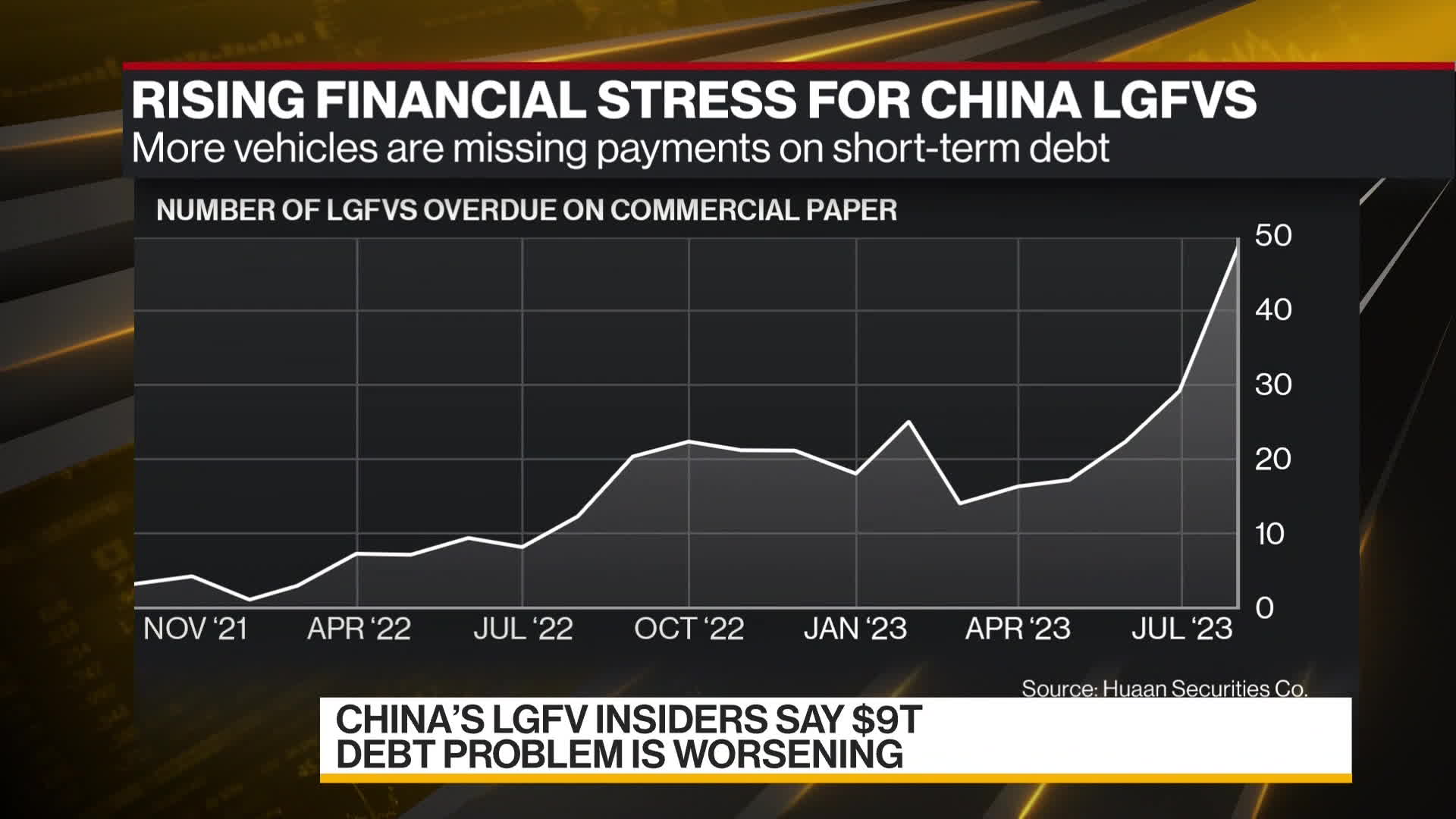

The lenders, which are smaller in terms of asset size compared to state banks, have relatively high exposure to local government financing vehicles (LGFVs) – the off-budget platforms set up by regional authorities to carry out infrastructure spending as well as investments. There are growing concerns over the default risks from LGFV debt as a result of a persistent downturn in the real estate market that has reduced revenue from land sales for many regions in China.

There are growing concerns over the default risks from LGFV debt as a result of a persistent downturn in the real estate market that has reduced revenue from land sales for many regions in China.

Local government revenues from land sales in September have yet to be released, but between January and August, they fell by 19.6 per cent year on year, far below the annual government growth target of 0.4 per cent.

Regional banks with concentrated exposure in resource-constrained regions, most of them in lower-tier cities, will likely feel the most pain

S&P Global Ratings

S&P Global Ratings estimated that Chinese regional banks had about 12 trillion yuan of exposure to the LGFVs as of the end of last year.

In a downside scenario involving substantial LGFV debt restructuring, 20 per cent of the 80 regional banks sampled by S&P could fall below the minimum regulatory capital adequacy ratio of 8 per cent, the ratings agency said on Wednesday.

This means the banks would need a fresh injection of capital, which would likely come from local governments.

“Regional banks with concentrated exposure in resource-constrained regions, most of them in lower-tier cities, will likely feel the most pain. And for some of these banks, the pain could be too much to bear by themselves,” the report said.

Creditors for Zunyi Road and Bridge Construction Group, a LGFV responsible for building infrastructure projects in Zunyi and other cities in Guizhou province, agreed to take significant reductions, raising questions over the impact of further LGFV debt restructuring on the banking system.

Bank of Hangzhou, Bank of Chongqing and Bank of Chengdu have the highest exposure to LGFVs among regional peers, according to S&P data.

S&P believes the central government would step in if local governments ran out of resources because maintaining financial stability is a priority for Beijing.

“However, such support would be aimed at containing systemic risks, and would not likely be entity-focused. Select credit events remain possible and could be painful,” S&P said.

The central government said in July it would come up with a “comprehensive” solution to resolve the local government debt crisis, although no details have been officially announced.

As China’s debt risks mount, the spectre of looming local crises rears its head

31 Jul 2023

[Deteriorating finances in some of China’s poorest provinces are seen as a “grey rhino” risk, with rising concerns over a possible meltdown in the banking system. Illustration: Henry Wong]

But since September, 17 provincial governments have issued special refinancing bonds totalling over 700 billion yuan (US$95.7 billion) for repaying LGFV debt, Moody’s Investors Service estimated.

China’s local government debt level has been piling up after years of rapid economic growth largely fuelled by heavy borrowing.

Japanese investment bank Nomura estimated, as of the end of September, local governments had outstanding explicit debt of 38.9 trillion yuan (US$5.3 trillion).

LGFVs, meanwhile, had outstanding bonds amounting to 13.4 trillion yuan, while other types of LGFV debt could be in the range of 35 trillion yuan to 50 trillion yuan, they added.

The outlook for local government finances is weak, increasing the likelihood of more fiscal transfer from the central government to local authorities, according to Nomura.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.