Cina's Overseas Bailouts!

https://www.youtube.com/watch?v=wfeDXy0bJb8

China spent $240bn on belt and road bailouts from 2008 to 2021, study finds

China spent $240bn (£195bn) bailing out countries struggling under their belt and road initiative debts between 2008 and 2021, new data shows.

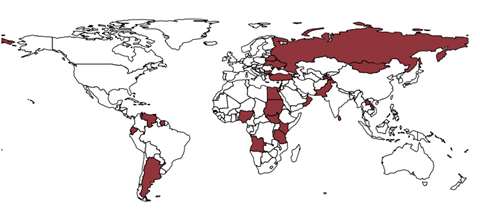

Research found that Chinese state-backed lenders released bailout funds to 22 countries, including Argentina, Pakistan, Sri Lanka and Ukraine. Almost 80% of the emergency rescue lending was issued after 2016, reaching more than $40bn in 2021.

The increase in emergency financing since 2016 correlates with a drop in Chinese lending for infrastructure projects that are part of the belt and road initiative. Commitments from China’s two main institutional lenders, China Development Bank and the Export-Import Bank of China (China Exim), fell from a peak of $87bn in 2016 to $3.7bn in 2021, according to data analysed by Boston University.

The failure of several infrastructure projects and the debt problems experienced by several recipient countries, hurt by the rising costs of servicing their loans, has forced a recalibration of China’s overseas development programme.

However, the war in Ukraine, the Covid-19 pandemic, supply chain problems and rising interest rates have contributed to a global economic crisis that has created difficulties for lenders of all kinds. China’s willingness to issue emergency financing may also therefore be an “acknowledgement that the belt and road initiative is as much about relationship-building as it is about infrastructure”, said Cobus van Staden, the managing editor of the China-Global South Project website.

“This lending will cement these relationships and make China even more central to [developing countries’] future economic trajectories.”

The share of Beijing’s overseas lending directed to borrowers in financial distress increased from 5% in 2010 to 60% in 2022, according to the study by researchers at AidData, the World Bank, the Harvard Kennedy School, and the Kiel Institute for the World Economy.

Bradley Parks, one of the report’s authors, said: “Emergency rescue lending is a very risky business. If you bail out borrowers that are in default or teetering on the edge of default, the challenge is knowing whether your borrower faces a short-term liquidity problem or a long-term solvency problem”.

Middle-income countries represent 80% of China’s total overseas lending, so Chinese banks have a particular incentive to make sure those governments remain sufficiently liquid to keep servicing debts related to belt and road infrastructure projects. Low-income countries account for less of Chinese banks’ total risk, so are more likely to be offered debt restructuring.

Because China is often the biggest bilateral creditor for low- and middle-income countries, Chinese assistance is crucial for countries in debt distress. In March the International Monetary Fund approved a long-awaited bailout for Sri Lanka worth almost $3bn after China Exim provided assurances that it would offer financial assistance to Colombo.

But Chinese support is not cheap. The study’s authors found that the average interest rate attached to a Chinese rescue loan was 5%, compared with 2% for a typical rescue loan from the IMF.

Chinese rescue lending is overwhelmingly directed at countries that already have high levels of debt to China. Carmen Reinhart, one of the study’s authors, said: “Beijing is ultimately trying to rescue its own banks. That’s why it has gotten into the risky business of international bailout lending.”

Some countries, such as Argentina, have effectively received continuous rollovers of Chinese rescue loans. This means that although loans may be booked as reaching maturity within 12 months, in practice they can be extended for several years.

Such practices are one of the many reasons that credit rating agencies and international institutions find it harder to monitor Chinese loans than those from multilateral lenders. The “serial rollovers” mean that governments in receipt of Chinese loans can underreport their public debt exposure, because international reporting rules only mandate the disclosure of debts with repayment terms of more than one year.

The massive growth in Chinese lending means that the global financial system is “more multipolar, less institutionalised, and less transparent,” said Christoph Trebesch, another of the report’s authors. “We see clear historical parallels to when the US started its rise as a global financial power, from the 1930s onwards and especially after world war two.”

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.