Pakistan wants to renegotiate hefty Chinese power deals

Pakistan wants to renegotiate hefty Chinese power deals

Beijing unlikely to concede to Islamabad's request, experts say.

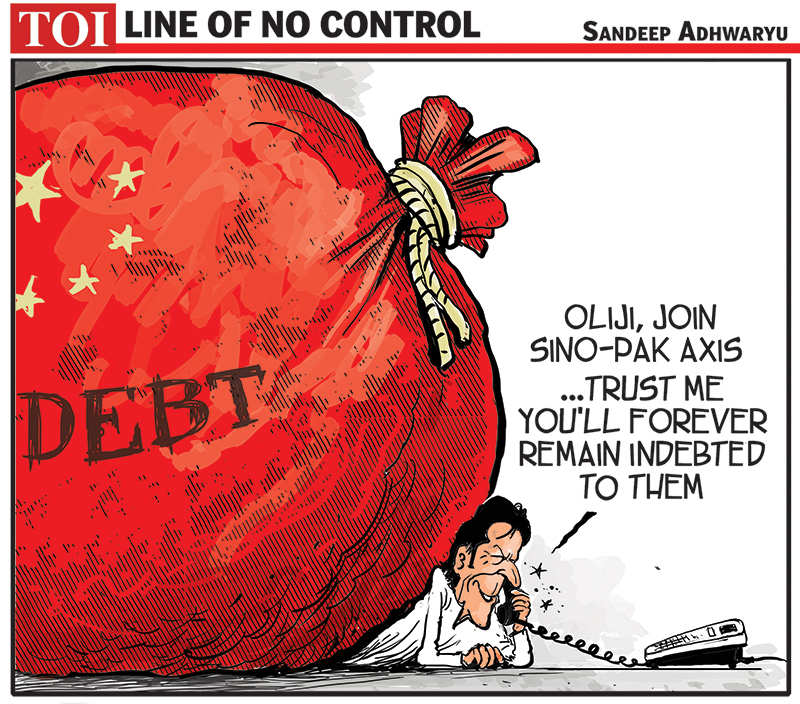

ISLAMABAD -- Pressure is growing on the Pakistani government to iron out agreements with power producers, especially Chinese companies, to bring down its energy bill which forms one of the biggest items in its budget and is an overwhelming burden for the population.

Finance Minister Muhammad Aurangzeb and Energy Minister Sardar Awais Ahmad Khan Laghari are in Beijing until Friday for talks with Chinese authorities. Local media reported that their aim is to delay Pakistan's debt payments -- worth more than $15 billion -- by five years.Chinese IPPs Refuse to Renegotiate Power Purchase Contracts with Pakistan.

Chinese companies have declared that they are not considering renegotiating the existing power purchase contracts with Pakistan. This development comes as Pakistan’s energy sector debt continues to mount, primarily due to capacity payments to power generation companies. Reports say that Pakistan pays billions of rupees without consuming electricity.

According to an Express Tribune report, representatives from three major Chinese companies stated that any decision to restructure the energy debt should be negotiated between Chinese banks and Pakistani authorities. The companies themselves have not shown a willingness to renegotiate the existing power purchase contracts.

If the Chinese authorities agree to these concessions, it could potentially lower electricity prices in Pakistan by Rs 6-7 per unit, with the impact from Chinese power plants under CPEC alone reducing prices by Rs 3-4 per unit.

“The 2014 power policy is the foundation of our investment in Pakistan,” a Chinese representative stated. “The core issue was uncontrolled and high line losses, theft, and low recoveries. The Chinese companies should not be blamed for the higher energy prices, as our cost of electricity is still cheaper than the government-owned power plants being run on LNG.”

“Even though we have been paid in local currency, the money stayed in Pakistan and due to currency depreciation, our profits have been eroded,” they added.

A representative from one of the largest Chinese power plants explained that energy companies themselves cannot decide on the restructuring of the debt. Any such decision must be made by the banks and the Chinese state-owned export credit agency, Sinosure, which provides insurance for these loans.

“It is meaningless whether or not the energy companies will agree to any proposal to renegotiate the terms,” the representative stated, implying that the ultimate decision-making power lies with Chinese financial institutions and Sinosure, not the power generation companies themselves.

Pakistan’s Finance Minister is traveling to meet with Chinese authorities to negotiate these requested changes to the energy debt repayment terms. Pakistan is seeking to convert the interest instruments on the energy debt from the Secured Overnight Financing Rate (SOFR) to the Shanghai Interbank Offered Rate (SHIBOR). Additionally, they are requesting a reduction in the interest rate spread over and above the SOFR or SHIBOR, which could cumulatively reduce the cost of the debt by around 5%, according to sources.

Furthermore, the government is seeking to extend the existing 10-year repayment period for the energy debt by an additional 5 to 8 years, spreading the cost of the debt in the energy tariff over a total period of 18 years.

In the current fiscal year, Pakistan is scheduled to make over $2 billion in energy debt repayments to China. Pakistan is seeking to postpone these repayments to gain relief during the current distressed economic times. The energy debt also includes loans taken to set up nuclear power plants with Chinese assistance, and Pakistan is seeking an extension on these loans as well.

The government has notified a new average electricity price of Rs 33 per unit, effective from July. Out of this, over Rs 18 per unit is due to “idle capacity payments” made under the Power Purchase Agreements (PPAs).

There is growing pressure from industrialists and residential consumers to renegotiate these PPAs to avoid high idle capacity payments. However, the government itself is a major beneficiary of these payments, followed by the Chinese power plants.

Executives from major Chinese power plants set up under CPEC, such as Sahiwal, Port Qasim, and China-Hubco, have stated that the “take or pay” conditions in the PPAs are based on the 2014 energy policy and cannot be reopened.

A Chinese executive noted that most countries buy electricity on a “take or pay” basis, and foreign investors would not be interested in setting up power plants in Pakistan on a “take and pay” basis instead.

Friday, July 26, 2024

Pakistan wants to renegotiate hefty Chinese power deals

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.