Eastern Mediterranean Energy Hangs in the Balance of the Israel-Hamas War

Unless the conflict spreads, the impact on the global economy should be manageable.

As the Israel-Hamas conflict threatens to spread, oil traders are paying a premium for their annual supply of most grades of Middle Eastern crude for 2024, according to Reuters. Though this seems to confirm what many suspect – that the conflict has irrevocably triggered increases in the price of energy – it’s unclear how much, and for how long, these increases will affect the global economy.

The usual caveats about the fog of war apply, of course, but so far

businesses in the region are operating under two potential scenarios.

The first is a confined war in which prices jump only a little

($4-$7 per barrel) and thus lead to a marginal increase in inflation

(0.1 percent). The second is a larger war that spreads throughout the

region. If it does escalate, oil prices could jump to as much as $150

per barrel, according to some estimates, potentially leading to a global recession with serious inflationary pressures.

The usual caveats about the fog of war apply, of course, but so far

businesses in the region are operating under two potential scenarios.

The first is a confined war in which prices jump only a little

($4-$7 per barrel) and thus lead to a marginal increase in inflation

(0.1 percent). The second is a larger war that spreads throughout the

region. If it does escalate, oil prices could jump to as much as $150

per barrel, according to some estimates, potentially leading to a global recession with serious inflationary pressures.

For its part, the Israeli economy is already starting to adjust to

the new normal, after what some consider an Israeli equivalent to 9/11.

Consumer spending is down, and as reservists get called up for the

fight, serious shortfalls in manpower have hurt supply chains at

seaports and supermarkets alike. GPF sources say daily rocket attacks

continue, and in some areas, rocket sirens are heard at least twice a

day, so the economic uncertainty in Israel isn’t going away any time

soon. The government, meanwhile, has vowed “no limit” spending to

finance the war and compensate affected individuals and businesses,

implying a larger budget deficit and more debt. The Economy Ministry has

established a war room

that as of late October had created a database connecting at least

8,550 people with failing firms. The Bank of Israel cut its economic

growth forecast for 2023 to 2.3 percent from 3 percent and its forecast

for 2024 to 2.8 percent from 3 percent. These forecasts assume the war

will be limited to Gaza.

For its part, the Israeli economy is already starting to adjust to

the new normal, after what some consider an Israeli equivalent to 9/11.

Consumer spending is down, and as reservists get called up for the

fight, serious shortfalls in manpower have hurt supply chains at

seaports and supermarkets alike. GPF sources say daily rocket attacks

continue, and in some areas, rocket sirens are heard at least twice a

day, so the economic uncertainty in Israel isn’t going away any time

soon. The government, meanwhile, has vowed “no limit” spending to

finance the war and compensate affected individuals and businesses,

implying a larger budget deficit and more debt. The Economy Ministry has

established a war room

that as of late October had created a database connecting at least

8,550 people with failing firms. The Bank of Israel cut its economic

growth forecast for 2023 to 2.3 percent from 3 percent and its forecast

for 2024 to 2.8 percent from 3 percent. These forecasts assume the war

will be limited to Gaza.

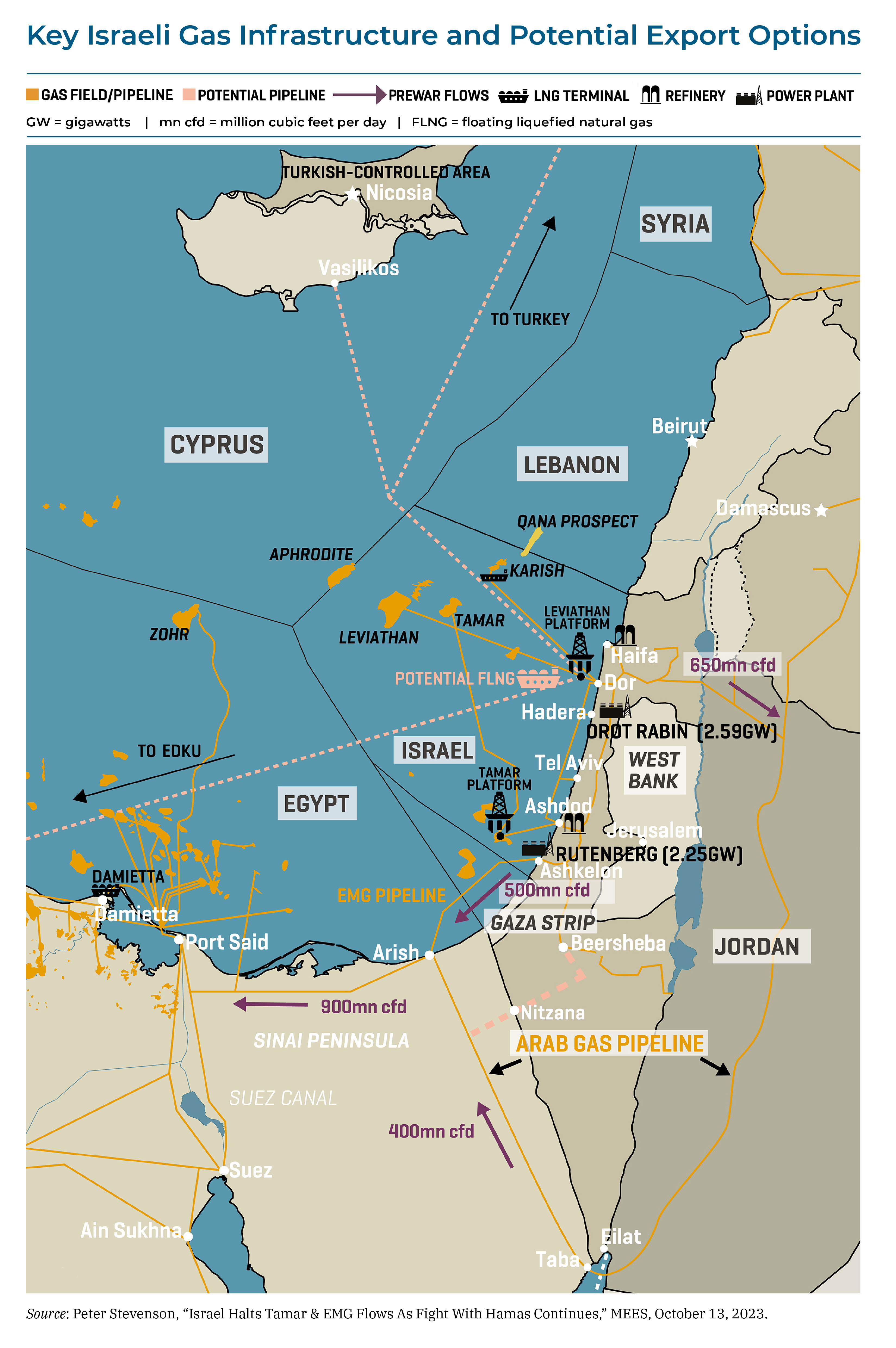

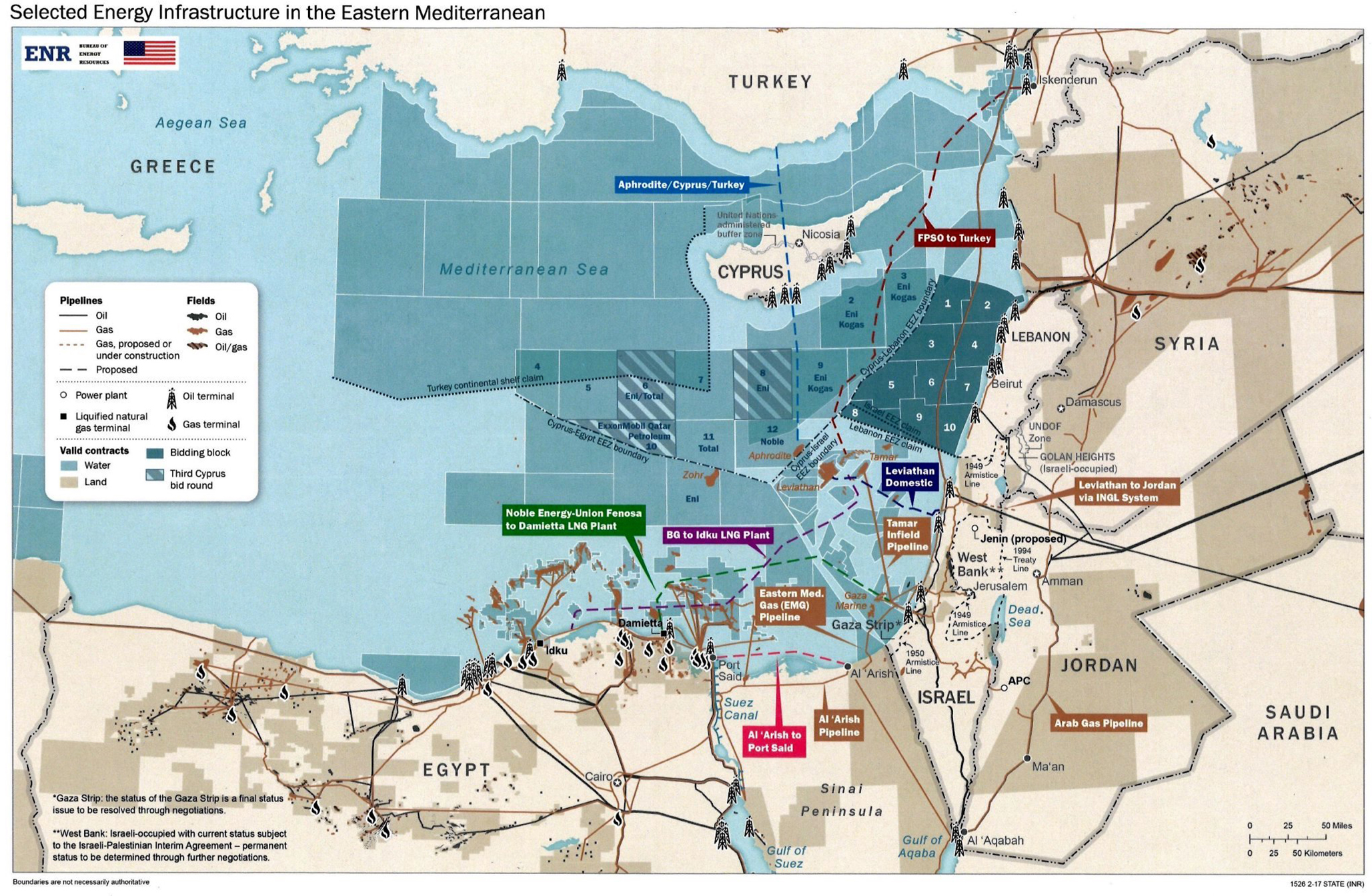

While Israel has halted electricity supplies to the Gaza Strip, it has also had to change its own consumption patterns. Natural gas accounts for 70 percent of Israel’s electricity generation and more than 40 percent of the country’s energy mix. The Energy Ministry has asked electric utilities to look for alternate fuel sources to meet their needs. It ordered Chevron to temporarily halt production on the Tamar field, which is located 25 kilometers (16 miles) from Gaza and largely serves domestic supply. It also directed Chevron to temporarily halt flows through the East Mediterranean Gas (EMG) pipeline, which connects Ashkelon, an Israeli city 13 kilometers north of Gaza, to Arish in Egypt’s northern Sinai. Though the EMG could no longer operate given its proximity to the battlefront, the cuts have had little effect on Israel’s overall energy supply.

However, offshore gas reserves have become a strategic asset for

Israel. The discovery of offshore gas reserves, most notably the Tamar

field in 2009 and the Leviathan field in 2010, has accelerated the

switch from coal to gas and driven a substantial overhaul of Israel’s

energy infrastructure, allowing it to become a gas exporter. In 2022,

Israel produced 21.9 billion cubic meters of gas, with Leviathan

producing 11.4 bcm and Tamar producing 10.2 bcm. Israel consumed 12.7

bcm and exported 5.8 bcm to Egypt and 3.4 bcm to Jordan. Exports were

expected to increase further in 2023. In light of the Ukraine war and

the EU’s efforts to find alternatives to Russian energy, Israel could

have enhanced its share in the global natural gas market.

However, offshore gas reserves have become a strategic asset for

Israel. The discovery of offshore gas reserves, most notably the Tamar

field in 2009 and the Leviathan field in 2010, has accelerated the

switch from coal to gas and driven a substantial overhaul of Israel’s

energy infrastructure, allowing it to become a gas exporter. In 2022,

Israel produced 21.9 billion cubic meters of gas, with Leviathan

producing 11.4 bcm and Tamar producing 10.2 bcm. Israel consumed 12.7

bcm and exported 5.8 bcm to Egypt and 3.4 bcm to Jordan. Exports were

expected to increase further in 2023. In light of the Ukraine war and

the EU’s efforts to find alternatives to Russian energy, Israel could

have enhanced its share in the global natural gas market.

In fact, the offshore gas reserves in Israel’s and other Eastern Med countries’ coastal waters have led to discussions over using energy to stabilize the regional economy. The war in Ukraine accelerated the will for these countries to work in exploiting and selling the resources to Europe. Last November, for example, a decades-long dispute over maritime borders between Israel and Lebanon ended, and according to the new borders, Lebanon has the right to explore the Qana or Sidon reservoirs, portions of which are located in Israeli territorial waters. Authorities in Beirut hope the agreement will help Lebanon rebuild its economy – hence why, so far, Hezbollah appears to be respecting unofficial red lines it shouldn’t cross despite rhetoric to the contrary.

Though the war will delay future energy operations and increase their costs, Israel seems intent on moving forward with them. On Oct. 29, it announced that six companies, including BP and Italy’s Eni, had been granted 12 licenses to explore and locate additional offshore natural gas reserves. This is the fourth offshore bid for natural gas exploration in Israel’s economic waters since 2010. The winning businesses in this bid will form two consortiums to explore two locations adjacent to Israel’s Leviathan field. (Eni, Dana Petroleum and Ratio Energies make up one group, while BP, Azerbaijan’s state oil company Socar and NewMed Energy represent the other.) Firms have three years to conduct exploration programs and can obtain two-year extensions for a total of seven years if they agree to drill at least one well.

All of this is to say that Israel has not just obtained new upstream investment from European oil companies but also secured their long-term commitment to the area – suggesting many companies are betting on a contained war scenario. And because they seem to agree that it may take six to 12 months for explorations to begin, firms like Eni are clearly in it for the long haul.

This wasn’t always the case. For years, companies tended to avoid upstream Israeli operations for fear of alienating Arab oil-producing governments. But the 2020 Abraham Accords changed the game. Chevron entered the market, prompting the United Arab Emirates sovereign wealth fund to invest in the Tamar gas field in 2021. BP expressed its interest in offshore projects in the Eastern Mediterranean, bidding, with Abu Dhabi National Oil Co., to acquire a 50 percent stake in Israeli gas producer NewMed Energy, despite the current Gaza conflict.

Chevron’s experience in Israel is a reminder of the resilience in conflict areas. After all, Tamar was targeted by rockets in 2021, and EMG has been shut down, its volumes redirected through an alternate regional network. However, if the Tamar and EMG shutdowns continue, the gas deliveries to Israel will be reduced, as will exports to Egypt.

In fact, the conflict has already complicated life in Egypt. While the country appears to have rejected all suggestions for accepting Palestinian refugees in exchange for external aid and debt forgiveness – a prospect reportedly floated by U.S. and European officials – the turmoil will continue to provide Cairo with opportunities to get concessions from its creditors and alleviate its severe economic problems. Concerned about the conflict’s destabilizing effects, which could increase irregular migration from Egypt to Europe, the European Union is looking into a partnership agreement with Egypt focused on migration and economic cooperation, the core of which would be a significant financial assistance package.

EU concerns about the status of Egypt will grow so long as the EMG continues to be offline. Prolonged lapses of gas will undermine Egypt’s ability to meet the energy demands of its people, as well as its ability to export liquefied natural gas to the EU. (Shipments are already lower this year compared with 2022.) Egypt isn’t an especially significant supplier, but in such a tight LNG market, and with winter just around the corner, prices have already increased in Europe and could increase in Asia soon too.

Ultimately, how long the Israel-Hamas conflict lasts will determine how much it affects the global economy. The appeals from Iranian Supreme Leader Ayatollah Ali Khamenei to Arab and Muslim nations for a trade embargo that includes oil against Israel haven’t yet made corporations begin to reevaluate their investment choices. None of the current foreign investors seem to want to leave.

Turkey is one potential outlier. Roughly 40 percent of Israel’s annual oil consumption is met by crude exported through Turkey’s Ceyhan terminal. But Ankara doesn’t appear to be on board with Israel’s response to the Hamas attacks. Turkish President Recep Tayyip Erdogan’s speeches in support of the Palestinians and the Turkish media reports that follow – both of which call on energy-rich Islamic countries to impose oil and natural gas embargoes on the West to halt Israeli airstrikes in Gaza – suggest that Turkey may well support Iran in an energy ban. But that may be easier said than done. According to Bloomberg, a Malta-registered oil tanker called the Seaviolet recently delivered 1 million barrels of Azerbaijani petroleum from Ceyhan to the Israeli port of Eilat. While Israel needs the crude coming from Ceyhan, Turkey also needs the revenue from facilitating oil exports to Israel. Rhetoric and protests aside, Turkey can’t afford to suspend any line of its trade with Israel, much less its energy cooperation.

The worst-case scenario – a wider conflict between Israel and the Arab states – could hamper energy cooperation in the Eastern Mediterranean. It would make Israeli gas initiatives with Egypt, Jordan and Lebanon much more difficult – if not impossible. The new gas developments are meant to establish a hub and boost regional trust. More sustained limits on Eastern Mediterranean export capabilities would be a setback, particularly for EU countries such as Italy that rely on the region’s energy as part of the transition away from Russian exports, and whose companies are investing in Eastern Mediterranean production and export infrastructure anyway. If Turkey joins the coalition against Israel, it will need to limit its own role in facilitating energy exports not only to Israel but also to Europe. But to do that, Ankara needs to produce more than political speeches. And while it has no interest in doing so, all businesses working with Israel to develop energy projects in the Eastern Mediterranean remain tentative but optimistic.

Antonia Colibasanu

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.